Data-Driven Site Selection: How Multi-Location Retailers Find Winning Sites (2026)

Written by: Clyde Christian Anderson

Why Top Retailers Are Abandoning Gut-Feel Site Selection

Data-driven site selection is the process of using analytics, location intelligence, and multiple data sources to identify optimal physical locations for businesses. This approach replaces gut feeling with objective analysis to maximize success rates.

The results speak for themselves: Cavender's Western Wear used this approach to open 27 new locations in 2025, compared to just 9 in 2024 before implementing a data-driven process. TNT Fireworks now reviews 10x more sites in committee meetings and opened 150+ locations in under six months.

What is data-driven site selection?

- A systematic approach using multiple data types (demographics, foot traffic, spending patterns) to evaluate potential locations

- Employs advanced analytics and AI to predict site performance with transparent scoring

- Reduces risk by quantifying factors that traditionally relied on intuition

- Enables businesses to analyze 5x more sites without sacrificing quality

Traditional site selection relied heavily on intuition and experience. Today's data-driven methods transform this process into a precise science, dramatically improving outcomes. Books-A-Million, for example, saves 25 hours per week per analyst using modern site selection platforms.

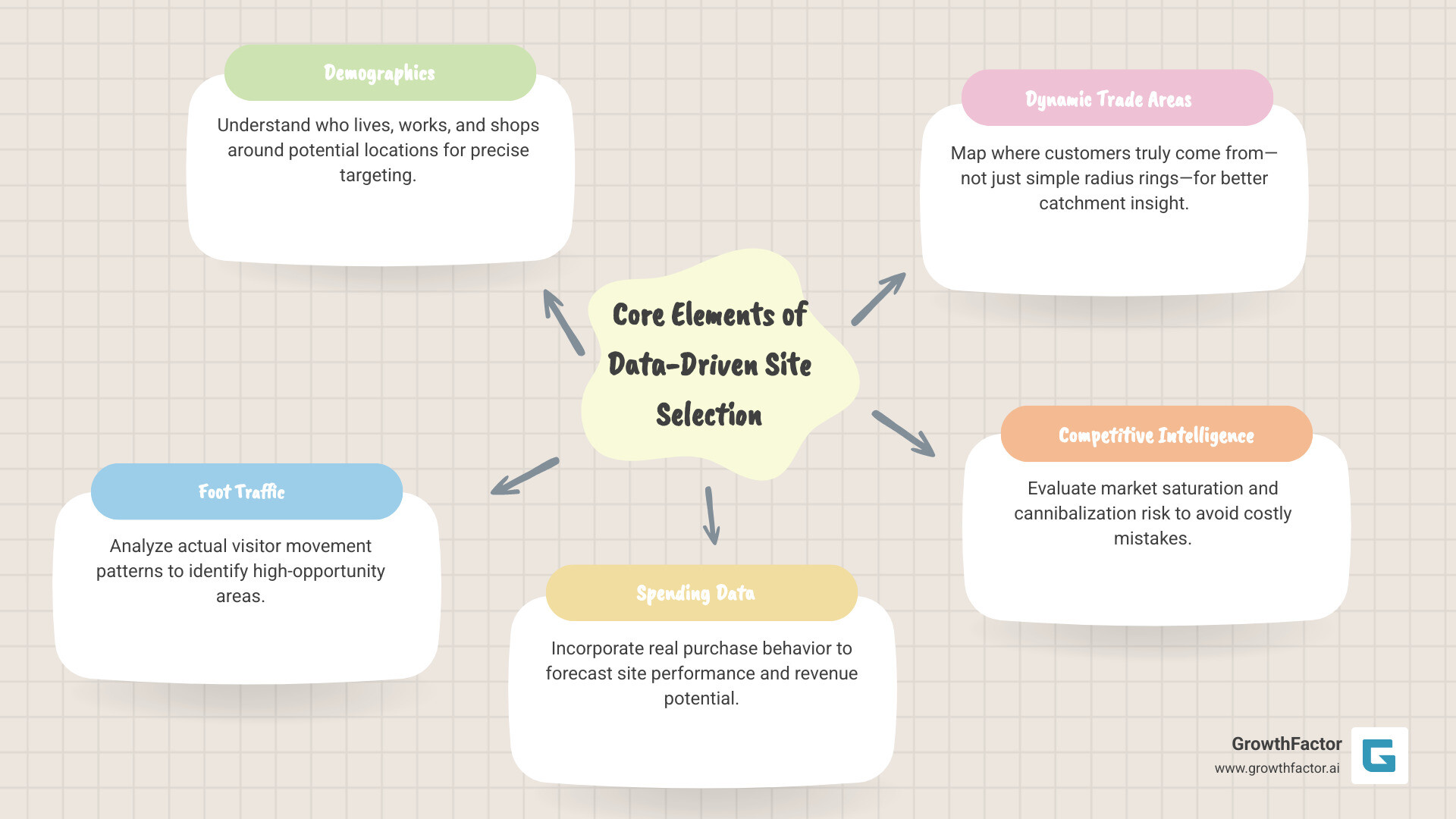

The most effective site selection process combines:

- Demographic data - who lives and works nearby

- Foot traffic analysis - actual visitor patterns

- Consumer spending data - real purchase behavior

- Dynamic trade areas - where customers truly come from (not just radius rings)

- Competitive intelligence - market saturation and cannibalization risk

I'm Clyde Christian Anderson, CEO of GrowthFactor.ai, with extensive experience implementing data-driven site selection strategies for retail brands across America after working in retail real estate where I personally experienced the limitations of traditional approaches.

Reading Guide

This guide will help you understand how to implement data-driven site selection in your organization. Whether you're a retailer looking to expand, a real estate professional seeking to make better recommendations, or an executive wanting to understand the ROI of location analytics, you'll find actionable insights here.

We'll cover:

- The fundamental difference between data-driven and traditional approaches

- Essential data sources and how to integrate them effectively

- A step-by-step framework for implementing data-driven site selection

- Tools and technologies that power modern site selection

- Common pitfalls and how to avoid them

What Is Data-Driven Site Selection and Why It Matters

Remember when choosing a new business location meant driving around neighborhoods, chatting with locals, and trusting your gut? Those days are quickly fading into history. Data-driven site selection has transformed this process from an intuitive art into a precise science that delivers measurable results.

In the past, real estate professionals relied heavily on experience and subjective assessments. They'd walk a site, feel the "energy" of an area, and make decisions based largely on intuition. While experience certainly has value, this approach left too much to chance in an increasingly competitive landscape.

Today's data-driven site selection harnesses the power of analytics, geospatial intelligence, and predictive modeling to make objective, repeatable decisions. Instead of educated guesses, businesses can now quantify exactly what makes a location valuable for their specific needs.

The impact is substantial. Consider this real-world example: Books-A-Million opened a store in a Delaware location that looked questionable on paper (near a cornfield, low traffic counts). But the data showed something everyone else missed. That store now outperforms expectations by 5x.

Data-Driven Site Selection vs Gut Feeling

| Aspect | Traditional Approach | Data-Driven Approach |

|---|---|---|

| Decision basis | Experience and intuition | Objective data analysis with transparent scoring |

| Evaluation time | Weeks to months | Days to weeks |

| Number of sites analyzed | Limited by human capacity | 5x more sites analyzed (TNT reviews 10x more) |

| Consistency | Varies by individual | Standardized methodology with visible reasoning |

| Risk assessment | Qualitative | Quantified and modeled with glass-box transparency |

Core Benefits for Multi-Location Retailers

When you adopt data-driven site selection, you're changing your business outcomes in several important ways.

First, you'll maximize customer reach. By analyzing demographic, psychographic, and behavioral data, you can find locations perfectly aligned with your target audience. Imagine knowing exactly where your ideal customers live, work, and shop before signing a lease.

Risk reduction is another major benefit. Modern platforms can quantify cannibalization risk before you open. When TNT Fireworks scaled from evaluating a handful of sites to reviewing 150+ locations in six months, they didn't just move faster. They made better decisions because the data showed which sites would steal from existing stores versus which would capture new customers.

Perhaps most compelling is the impact on your bottom line. Cavender's avoided three locations that looked promising on paper but the data flagged as problematic. That's approximately $2M in avoided bad investments.

The Data Stack: From Demographics to Dynamic Trade Areas

Ever wondered how retailers seem to know exactly where to open their next location? The answer lies in having the right data. Today's data-driven site selection is powered by a rich mix of information that goes far beyond basic demographics.

Think of it as building a complete picture of a location, one data layer at a time. Each layer reveals something new and valuable about the site's potential.

Demographics are still the foundation: population density, income levels, age distribution, and education stats give us the basics. But modern approaches dig deeper, looking at census block groups rather than broad zip codes. This granularity matters because two neighborhoods within the same zip code can have dramatically different characteristics.

The real magic happens when we add psychographic data to the mix. Now we're not just seeing who lives near a location, but understanding how they live. Their lifestyle preferences, brand affinities, and values help businesses connect with the right customers.

Perhaps the most exciting development in recent years is mobility and foot traffic data. As one retail expert told me: "Seeing how people actually move through space is a game-changer."

This data reveals visitor counts by time of day, how long people stay, and crucially, where they come from. Traditional methods assumed customers came from neat circular areas around a store. Reality is messier and more interesting. Modern analysis shows that up to 20% of visitors travel from well beyond the expected radius.

Integrating Multiple Data Sources

The real power of data-driven site selection comes from bringing all these data sources together. The challenge is that most teams juggle multiple tools: Placer for foot traffic, spreadsheets for scoring, Esri for mapping, and email for broker submissions.

One retail analyst described their old process: "That was like such an ugly Google form into a Google sheet that was like where I had to organize my brain." Another said: "How do I export all of that and compare everything at once on a giant table of 1,200 rows?"

Modern site selection platforms solve this by unifying data sources into a single workflow. Instead of exporting, VLOOKUPing, and manually scoring, teams get a consolidated view with transparent scoring they can trust.

Foot Traffic and Dynamic Trade Areas

Forget simple radius circles around potential locations. They rarely reflect reality. Dynamic trade areas represent a major leap forward in understanding where customers actually come from.

Using mobile location data, we can map true visitor patterns that reveal:

- Trade areas shaped by roads, natural barriers, and competing attractions, rarely perfect circles

- Different customer catchment areas depending on time of day

- Trade areas that evolve as neighborhoods and traffic patterns change

One GrowthFactor customer, Abbott's Frozen Custard (name changed), discovered their true trade area extended 23 minutes, not the 16 minutes they'd assumed for years. That insight changed their entire expansion strategy.

For deeper insights into human mobility data, check out the mobility dataset marketplace where you can explore various data options.

A Five-Step Data-Driven Site Selection Playbook

Finding the perfect location shouldn't feel like searching for a needle in a haystack. With a structured approach to data-driven site selection, you can transform this challenging process into a repeatable, reliable system that delivers consistent results. Here's our practical five-step playbook that has helped countless businesses make smarter location decisions.

Step 1: Define Goals and Scoring Matrix

Before diving into spreadsheets and maps, you need clarity on what success looks like for your business. This crucial first step sets the foundation for everything that follows.

Start by getting crystal clear on your objectives. Are you aiming to maximize revenue in new markets? Establish strategic presence in underserved areas? Improve brand visibility? Different goals require different location priorities, and being specific now saves headaches later.

Next, develop a weighted scoring matrix that reflects what truly matters for your business. Think of this as your location "report card" with grades for factors like:

Property and sales tax implications that directly impact your bottom line

Land and construction costs that affect your initial investment

Demographic alignment with your ideal customer profile

Competitive positioning in relation to similar businesses

The key is transparency. Modern platforms use what we call a "glass box" approach: you see exactly why each score is what it is. Unlike black-box systems where a number appears with no explanation, glass-box scoring shows the reasoning behind every recommendation.

Step 2: Assemble and Clean the Data

With your goals clearly defined, gather the ingredients for your analysis. This step is where the foundation of quality insights is built.

Identify which data sources will provide the specific insights your business needs. Different retail concepts require different data layers, so be intentional about what you collect.

Data quality matters tremendously here: garbage in, garbage out applies perfectly to site selection. Implement thorough quality checks to ensure your information is accurate, complete, and current.

Step 3: Analyze Trade Areas and Model Demand

Now comes the exciting part: turning raw data into actionable insights about where your customers will come from and how much business you can expect.

Forget simple radius rings. Use mobility data to define true trade areas based on actual customer movement patterns. As one analyst explained: "True Trade Area analysis provides a higher-resolution catchment area than simple radius-based methods."

Map accessibility through isochrones: visual representations of how far people can travel in 5, 10, or 15 minutes from different directions. This reveals the actual reach of your location, accounting for natural barriers and traffic patterns.

Step 4: Run Scenario and Risk Analysis

Smart site selection isn't just about finding good locations. It's about understanding and managing risks. This step helps you prepare for various possible futures.

Cannibalization analysis is essential for multi-location businesses. Will your new location steal customers from existing stores? Studies show over 22% of visitors to a store might also visit a nearby center, indicating potential sales transfer that could undermine overall performance.

Assess market saturation to avoid the common trap of overexpansion. There's a tipping point where adding more locations yields diminishing returns, and data can help you identify when you're approaching that threshold.

Step 5: Visualize and Present Findings

Even the most brilliant analysis is worthless if decision-makers can't understand it. This final step transforms complex data into compelling, actionable recommendations.

Interactive dashboards allow stakeholders to explore insights at their own pace and focus on what matters most to them. This self-service approach builds confidence in your recommendations.

Data storytelling is where science meets art. Craft a narrative that explains not just what the data shows, but why it matters and how it should influence decisions. The human brain is wired for stories, not spreadsheets.

Tools, Software, and Predictive Models for Data-Driven Site Selection

The right technology can make or break your data-driven site selection strategy. Think of these tools as the engine that powers your location decisions: they transform raw data into actionable insights that drive business growth.

When I talk with retail executives, they often ask which tools they should invest in. The answer depends on your specific needs, but understanding the landscape helps make informed decisions.

Geographic Information Systems (GIS)

At the heart of spatial analysis are GIS platforms that help you visualize location data. Tools like ESRI ArcGIS provide powerful mapping capabilities, while open-source alternatives like QGIS offer flexibility without the hefty price tag. These platforms let you layer different data sources: from demographics to competitor locations, creating rich visual stories about potential sites.

Business Intelligence (BI) tools like Tableau and Power BI complement GIS by handling the non-spatial aspects of your analysis. They're particularly good at creating interactive dashboards that help stakeholders explore the data themselves.

What's changed the game in recent years are specialized site selection platforms that bring everything together in one place. These purpose-built solutions combine mapping, analytics, and predictive modeling in workflows designed specifically for location decisions.

Choosing the Right Tech Stack

Finding the right technology mix comes down to four key considerations:

Automation needs matter tremendously. How much of the process do you want to handle automatically? Modern platforms can take you from data collection through preliminary analysis without manual intervention, freeing your team to focus on strategic decisions rather than spreadsheet wrangling.

Scalability becomes crucial as you grow. Can your solution handle five locations? Fifty? Five hundred? The right platform grows with you, maintaining speed and accuracy even as volume increases.

Transparency separates good platforms from great ones. Can you see why the model recommends Site A over Site B? Glass-box platforms show their reasoning; black-box tools just give you a score. When you're making million-dollar decisions, you need to understand the "why."

Leveraging Predictive Models and Scenario Planning

The real magic happens when you move beyond descriptive analysis ("what is") to predictive insights ("what could be"). Modern data-driven site selection leverages sophisticated models that forecast performance before you sign a lease.

Sales forecasting models analyze multiple variables: from foot traffic to competitor density, to predict potential revenue. The best models learn and improve over time, comparing predictions against actual performance to refine their accuracy.

Capture rate analysis helps you understand what percentage of the available market a location might secure. This becomes especially valuable when evaluating saturated markets where competition is fierce.

Data-Driven Site Selection Success Metrics

How do you know if your data-driven site selection program is working? Track these key metrics:

Time-to-decision measures how quickly you can evaluate potential sites. Books-A-Million, for example, saves 25 hours per week per analyst, allowing them to move quickly when prime locations become available.

Sites analyzed quantifies how many locations you can thoroughly evaluate. TNT Fireworks went from reviewing a handful of sites to 10x more in committee meetings, dramatically increasing their chances of finding hidden gems.

Prediction accuracy compares forecasted performance against actual results. This becomes your north star for continuous improvement, helping refine models over time.

Avoiding Pitfalls and Mitigating Risk with Data

Even the most sophisticated data-driven site selection process isn't foolproof. The path to finding perfect locations is filled with potential stumbling blocks that can trip up even experienced real estate teams. Here's how to navigate these challenges with confidence.

Common Mistakes to Avoid

Have you ever watched someone confidently walk in the wrong direction while looking at their GPS? That's exactly what happens when teams have powerful data tools but use them incorrectly.

One of the most common missteps is failing to clearly define what success looks like for a location. Without specific, measurable criteria, you're essentially searching without knowing what you're looking for. As one client told us after implementing a data-driven platform: "We spent years arguing about locations because everyone had different ideas of what 'good' meant. Having clear criteria changed everything."

Another frequent pitfall is treating all factors equally in your analysis. Foot traffic might be vital for a coffee shop but less important for a specialty retailer with destination customers. Your scoring model should reflect these differences through thoughtful weighting.

Many teams also fall into what I call "data tunnel vision": becoming so enamored with quantitative metrics that they ignore qualitative factors that don't fit neatly into spreadsheets. Behind every data point are real people making real decisions about where to shop.

Cannibalization, Saturation, and Trend Shifts

Smart retailers understand that opening a new store isn't just about that location's potential. It's about how it fits into the broader network. Data-driven site selection excels at quantifying complex relationships between locations.

Cannibalization analysis reveals uncomfortable truths that gut feeling often misses. When analysis showed one retailer that 22% of their customers were visiting multiple locations, they realized their expansion strategy was creating competition within their own brand. This insight helped them space new locations more strategically.

Market saturation is the silent killer of retail profitability. Data analysis can identify when a market is approaching the tipping point where additional locations yield diminishing returns.

Frequently Asked Questions about Data-Driven Site Selection

How does a dynamic trade area differ from a simple radius?

A simple radius assumes customers come equally from all directions and that distance affects everyone the same way. That's almost never true.

Dynamic trade areas reflect how customers actually move in the real world. They account for natural obstacles and flow patterns: train tracks nobody crosses, rivers that limit movement, the psychological barrier of crossing into a "different" neighborhood.

Our analysis often reveals up to 20% of traffic comes from well beyond traditional 5-mile circles. These "outlier" customers might travel much farther than expected because of convenient highway access or because you offer something truly unique.

Which data layer has the highest impact on forecast accuracy?

The most powerful combination is foot traffic data paired with consumer spending data. These two together create a remarkably clear picture of commercial potential.

Foot traffic shows who actually visits, while spending data reveals who opens their wallet and how much they spend. Together, they bridge the critical gap between interest and action.

How can I monitor performance after a site opens?

Opening day isn't the finish line. It's the starting line. Smart retailers treat site selection as an ongoing learning process.

Create a performance dashboard that tracks your key metrics against forecasts. Are sales matching predictions? Is traffic building as expected? Are conversion rates where they should be? This dashboard becomes your early warning system.

Use mobile location data to verify if your actual trade area matches what you predicted. Sometimes the customers who show up aren't exactly who you expected, which offers valuable insights for future locations.

What makes a "glass box" approach different from black-box scoring?

Black-box systems give you a score (say, 78 out of 100) with no explanation of how they got there. You're expected to trust the number without understanding the reasoning.

Glass-box platforms show you exactly why a site scores the way it does. You can see the individual components: foot traffic score, demographic fit, competitive landscape, visibility, and market potential. More importantly, you can see the data and logic behind each component.

When you're presenting to a CEO or investment committee, "the model said so" isn't persuasive. Being able to explain "this site scores high on demographics because average household income is $92K (15% above our benchmark) and 34% of households have children (matching our target profile)" builds confidence in the decision.

How do multi-location retailers use data-driven site selection to scale expansion?

Multi-location retailers face a unique challenge: they need to evaluate many sites quickly without sacrificing quality. The old approach of deeply analyzing 5-10 sites per quarter doesn't work when you're planning to open 20+ locations per year.

Modern data-driven approaches solve this by automating the initial screening. TNT Fireworks, for example, went from reviewing a handful of sites to evaluating 10x more in each committee meeting. They opened 150+ locations in under six months using this approach.

The key is using data to quickly filter out poor candidates and focus human attention on the most promising opportunities. Analysts spend their time on strategic decisions, not manual data gathering.

What platforms help with data-driven decision making in retail real estate?

The market includes several categories of tools:

Foot traffic platforms (Placer, Unacast) provide mobility data showing how people move through spaces.

GIS and mapping tools (ESRI, QGIS) offer spatial analysis and visualization capabilities.

Purpose-built site selection platforms (like GrowthFactor) combine multiple data sources with scoring, deal tracking, and collaboration features designed specifically for retail real estate teams.

The best choice depends on your team size, expansion pace, and how much of the process you want to automate versus handle manually.

Taking the Next Step with Data-Driven Site Selection

Data-driven site selection has transformed location decisions from gut feelings into strategic science. This shift isn't just about using more technology. It's about fundamentally changing how businesses approach their most important real estate decisions.

When you replace hunches with hard data, the results speak for themselves. Cavender's Western Wear opened 27 new stores in 2025 compared to 9 in 2024, tripling their expansion pace. TNT Fireworks reviews 10x more sites in committee and opened 150+ locations in six months. Books-A-Million saves 25 hours per week per analyst, time they now spend on strategic decisions instead of data wrangling.

At GrowthFactor, we've built our platform specifically to make these benefits accessible to businesses of all sizes. We understand the challenges of modern site selection because we've lived them ourselves. Our solution brings together the critical data sources you need, automates the complex analysis that used to take weeks, and presents everything with glass-box transparency so you can see exactly why one site beats another.

The five-step framework we've outlined throughout this guide isn't just theoretical. It's a practical roadmap that any organization can follow:

- Define your goals and create a thoughtful scoring matrix

- Gather and clean the relevant data (no analysis is better than its foundation)

- Analyze true trade areas and build realistic demand models

- Run scenario planning and risk analysis to test assumptions

- Visualize and present your findings in ways that drive action

I've seen how this approach can transform an organization's growth trajectory. Teams move from being data gatherers to strategic advisors. They close more deals without adding headcount. And most importantly, their locations perform better over the long term.

Ready to elevate your site selection process? We've designed our pricing to be accessible at any scale. Our Core plan starts at $500 per month for smaller teams just getting started with data-driven methods. Our Growth plan at $1,500 monthly offers expanded capabilities for teams ready to fully adopt this approach.

The retail real estate landscape is changing rapidly. Data-driven site selection isn't just a competitive advantage anymore. It's becoming table stakes. The question isn't whether to adopt these methods, but how quickly you can implement them before your competition does.

Citations

The human algorithm

Request Your demo

Schedule meeting

Or submit your information below and we'll be in touch to schedule.